The connection between the European Bank for Reconstruction and Development and the countries of Central and Eastern Europe is powerful. The Bank was created expressly to facilitate the transition of the communist countries formerly behind the Iron Curtain to the free market, and as of June 30, 2014, it has invested EUR 72 billion in the region – including EUR 2.6 billion so far this year alone. We decided to learn a bit more about what the Bank is, how it works, and what the lawyers who work within it do.

The Bank’s History and Focus: A Growing Reach

The European Bank for Reconstruction and Development was first proposed by French President Francois Mitterrand in October 1989, and it opened for business in April 1991. The Bank’s mission statement declared that it was established to “promote entrepreneurship and foster transition towards open and democratic market economies.” To achieve that goal, the Bank invests primarily in private sector clients who struggle to obtain financing from more traditional sources, as according to the Bank’s website, “the EBRD’s main advantages, compared with private commercial banks, lie in its willingness and ability to bear risk, as a result of its shareholder base.”

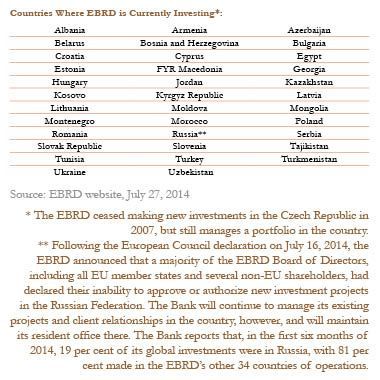

Although the Bank was founded to assist countries of Eastern Europe establish their private sectors, its geographic and geo-political focus has since expanded, and at the moment the EBRD is operating in 35 countries, including Mongolia (since 2006), Turkey (since 2009), Jordan, Tunisia, Morocco, Egypt and Kosovo (since 2012) and Cyprus (since 2014).

The Bank is active in all CEE countries, with the exception of Austria, Greece, and the Czech Republic, which in 2008 became the only member to “graduate” from the Bank. (In 2006, the EBRD declared that it expected to conclude its investments in the Baltics and Central Europe by 2010, and would shift funding to Russia, Ukraine, Armenia, Kazakhstan, and Uzbekistan, but due to the global economic crisis that transition was later postponed until 2015).

The Bank now has over 1500 employees, and it is owned by 64 countries and two European institutions. Despite its name, the largest shareholder in the Bank is the United States.

The Bank’s Mission: A Bouillabaisse of Freedom, Capitalism, and Democracy

The Bank claims that “every EBRD investment must help move a country closer to a full market economy.” The Bank works only in countries that are “committed to democratic principles,” and it does not finance defense-related activities, the tobacco industry, selected alcoholic products, substances banned by international law, or stand-alone gambling facilities.

Within those parameters, the Bank’s investments are impressively diverse. It offers loan and equity finance, guarantees, leasing facilities, and trade finance, to banks, industries, and businesses, both new ventures and investments in existing companies. It also works with publicly-owned companies. Direct investments generally range from EUR 5 million to EUR 230 million, and the Bank typically funds up to 35 per cent of the total project cost.

Despite its unique mission and mandate, the Bank is not a charity. Thus, “while its structure is unlike that of a commercial bank … the EBRD has a similar approach to dealing with projects, [and] a project has to be commercially viable to be considered.” Ultimately, to be eligible for EBRD funding, “a project must be located in an EBRD country of operations, have strong commercial prospects, involve significant equity contributions in-cash or in-kind from the project sponsor, benefit the local economy, and help develop the private sector and satisfy banking and environmental standards.”

Of course, the Bank has its critics. Environmentalists and a number of NGOs have complained that, although its charter states that the Bank is to “promote in the full range of its activities environmentally sound and sustainable development,” the Bank does not always live up to this obligation, and often finances projects which its critics believe are environmentally harmful. Other critics note that the success of the Bank’s efforts is not always clear, and some have pointed out that despite the EBRD’s mission statement, the Bank’s own 2007 report showed that 67% of the people in its countries of operation believe that corruption was the same or worse in 2006 compared to 1989.

Lawyers in the EBRD: Combining Moral Purpose and Challenging Work

The EBRD’s legal department has, at the moment, approximately 90 lawyers, about half of whom are members of the banking operations group. They work on specific transactions and each have about 70 transactions in their portfolio. They are assisted by the (about 12, currently) lawyers in the Bank’s Associate Program, designed to attract young lawyers from the countries of operation of the EBRD.

Another team of lawyers focus on corporate recovery and litigation, and the finance team provides assistance to the Treasury Department. There is also a legal transition team working to help promote legal reforms and institution building in countries where the Bank invests. According to Anthony Williams, the Head of Media Relations at the Bank, these lawyers “advise governments in such fields as concessions/PPPs, contract enforcement and judicial capacity, corporate governance, energy and energy efficiency regulatory reforms, insolvency and public procurement among many others. They are also responsible for knowledge management in the legal department and produce a biannual publication entitled ‘Law in Transition.’”

To peel back the curtain and get some insight into the inner workings of the EBRD legal department, CEE Legal Matters spoke to three of its senior lawyers.

Jelena Madir, who obtained her law degree at Columbia in the United States in 2003, worked for three years in Washington D.C. with Cleary, Gottlieb, Steen & Hamilton before returning to her native Croatia. In 2008, finding a shortage of complex, challenging work in the country, she joined Shearman & Sterling in Frankfurt, and 8 months later applied online for a position with the EBRD. She joined the Bank in March, 2009, and is now Senior Counsel.

Rustam Turkmenov is a Principal Counsel at the EBRD. He started his career at the IFC in his native Uzbekistan in 2003, and after two years moved to the IFC’s office in Russia. In 2008 he completed his LL.M. at King’s College in London and – like Kairys – joined the EBRD’s Associate program. He left in 2010 to join Standard Bank Corporate and Investment Banking in London, but when that bank revised its global strategy shortly after his arrival his opportunities to work in CEE and Russia/CIS became limited, and he returned to the EBRD, where he remains today.

Tomas Kairys, from Lithuania, obtained an LL.M. from the University of Cambridge in 1999, then was accepted into the EBRD’s “Associate” program, where he worked from 2000-2002, before returning home. After three years with EY Law in Vilnius, he became an Associated Partner at Jurevicius, Balciunas & Partners, but a short 11 months later decided he missed the challenges provided by the Bank. He rejoined the EBRD in October, 2006, and since 2012 he has been working as a Senior Counsel from the EBRD’s resident office in Istanbul, where he focuses primarily on Turkish and Central Asian projects.

Jelena Madir, Tomas Kairys, and Rustam Turkmenov all enjoy the unusually high degree of autonomy the Bank provides, and the opportunity to work on a wide variety of deals in a wide variety of jurisdictions. The process starts, usually, with a list of new projects circulated every week, which the Bank’s lawyers are invited to review and volunteer for. “So you can really design your own portfolio,” Madir explains, “and be as specialized as you wish to, or as much of a generalist as you wish …. In other words, you can get anything from agribusiness, natural resources, municipal deals, sovereign deals, power and energy.” In practice, Madir claims, few of the EBRD’s lawyers specialize by product or sector, or even by geography. “I’m certainly not,” she says, “so I have quite a broad portfolio covering Central Asia, Russia, North Africa [and] Central Europe, including Croatia.”

Kairys says that the Bank actively encourages this generalization. “I think that’s how our department is designed,” he says. “That’s the intention for us to have the chance to work on different projects, so we have a better view of the potential issues that arise in different countries, and in different sectors, so we can use that experience.”

Kairys says that the Bank actively encourages this generalization. “I think that’s how our department is designed,” he says. “That’s the intention for us to have the chance to work on different projects, so we have a better view of the potential issues that arise in different countries, and in different sectors, so we can use that experience.”

Unsurprisingly, this opportunity to work on deals across the Bank’s countries of operations applies less to the six or seven lawyers stationed at one of the Bank’s “resident offices” in Moscow, Kiev, and Istanbul. Kairys – who himself is nearing the end of a 3-year assignment in Istanbul – explains: “The idea is … to be slightly closer to the clients,” he says, “and to sort of understand the local market, not just the businesses, but also the local legal market, because on most of our transactions, if not all of them, we actually do work with local counsel, so by being here we’re closer to them and get to understand the local legal market much better.”

The selection of external counsel on a transaction — when one is required — is often made personally by the Bank’s counsel, whether working from London or a resident office. Madir explains that the EBRD doesn’t have a pre-selected panel of law firms in each market, and to be considered as local counsel a firm must only register with the Bank (Kairys calls this “a very simple technical process”). Once this registration is complete, it’s up to the EBRD lawyer assigned to the project to select local counterparts. According to Madir, “that means that each lawyer has a bit of discretion regarding which law firm they’re going to work with.”

In addition to simply relying on previous first-hand experience, the Bank keeps a database documenting experience with local counsel. “We all write evaluations about the law firms that we’ve worked with,” Madir explains, “so then you will typically look at what your colleagues have said about a law firm, about whether they’ve been happy with the law firm’s work. Also, if the scope of work is above a certain threshold [EUR 75,000], then we have to run a competitive selection and we have to invite four law firms to bid.”

Of course, specialization is also a factor. “When you select a shortlist of firms you also look at the experience or specialization of these firms in particular sectors where the EBRDs potential clients operate,” Turkmenov says, “which is quite important in making the best selection, as the firm’s familiarity with various business models usually expedites efficient legal structuring for specific deals.”

Unsurprisingly, lawyers tend to be more open to trying new firms on smaller deals. “Personally I try to give firms a chance,” Madir says. “I’m approached by firms that would like to work with the EBRD, and I try to test them on a simpler deal to see what they’re like, but of course because quality is very important, for more complex deals, I will certainly use a firm I’ve already used and that I know is going to deliver good quality work.”

Madir, Turkmenov, and Kairys insist their roles are more challenging and hands-on than they would be at a commercial bank, where lawyers may be encouraged to outsource more of the work. Madir believes that “the reason we have a large legal department is because we do a lot of work in-house …. We are very involved in the whole process, from the very beginning, from when it gets approved by the credit committee, to the term sheet, mandate letter, and confidentiality agreement, and often draft key transactions documents as well, such as loan agreements and subscription agreements … it’s definitely very hands-on.”

Turkmenov agrees. “I think we are much more involved in the transaction than typical in-house lawyers in the majority of private sector banks,” he says. “And having had experience with other banks in the City, it’s definitely true that EBRD lawyers are more involved in the projects starting from origination to a post-closing period.”

Finally, the unique mandate of the Bank is not unrelated to its appeal. The Lithuanian Kairys speaks in no uncertain terms. “Coming from one of those countries of operation originally, I do associate with the mandate of the Bank, and the fact that it’s a multi-national development bank means I like the mandate very much. That’s why I’m here.”

Madir concurs, noting that “every time I visit a commercial bank I can feel the atmosphere is different, from a bank that’s not driven solely by making money and the bottom line. I think the atmosphere of a development bank makes it a very pleasant place to work at.”

Turkmenov adds his voice to the others: “I agree with everyone that our mandate, and the feeling that you get when you work on the projects that the Bank does in the region, is definitely one of the key reasons why people are here in the Bank.”

The lawyers speak with sentiment about the opportunity to return to their home countries some day – but point out that the size of their respective legal markets makes this impractical. Madir is blunt: “I feel for me, given my background and international work experience, I would find it a bit stifling professionally to be based in Croatia.” Still, she continues to teach courses at a private business school in Croatia twice a year, which “gives me a way to stay connected,” and allows her to “feel like I’m giving something back to the younger generation of my country.”

For his part, Turkmenov says he hopes someday to go back home to work in Uzbekistan, but “it should come when the moment is right, and when I feel I’ll be able to get as many professional challenges and opportunities to learn as I have now working on international finance projects.”

Kairys, like Madir, tried to go home once before: “I tried to go back, and I liked it, but the opportunities that are provided there are very local, so having tasted international lawyers’ work, and the ability to work in different countries on a wide range of projects, it is a very different role that one can find working in a small local market.” Still, he says, “I do not exclude the possibility of coming back to my country at some point in a potentially different role.”

* Thanks also to Anthony Williams and Olga Rosca for their help in putting together this story.

Kairys says that the Bank actively encourages this generalization. “I think that’s how our department is designed,” he says. “That’s the intention for us to have the chance to work on different projects, so we have a better view of the potential issues that arise in different countries, and in different sectors, so we can use that experience.”

Kairys says that the Bank actively encourages this generalization. “I think that’s how our department is designed,” he says. “That’s the intention for us to have the chance to work on different projects, so we have a better view of the potential issues that arise in different countries, and in different sectors, so we can use that experience.”