Schoenherr, Clifford Chance, and Jadek & Pensa have advised on the successful EUR 1 billion restructuring and refinancing of Slovenia’s Mercator Group.

Schoenherr acted as lead counsel to the co-ordinator Erste Group Bank and the coordination committee (consisting of Nova Ljubljanska banka; Raiffeisen Bank International; SKB banka; UniCredit Banka Slovenija; and VTB Bank) of the consortium of more than 50 creditor banks, while Clifford Chance and Slovenia’s Jadek & pensa advised the Mercator Group. Comprehensive documentation for the financial restructuring was signed on June 9, 2014.

Schoenherr described the project as “one of the most extensive, complex, and challenging financial restructuring processes of its kind in this part of Europe.” The Mercator Group is one of the largest Slovenian corporate groups, and is the leading retail chain in Southeastern Europe. Schoenherr advised the creditors in all of the jurisdictions involved in the matter: Slovenia, Croatia, Bosnia and Herzegovina, Montenegro, and Serbia.

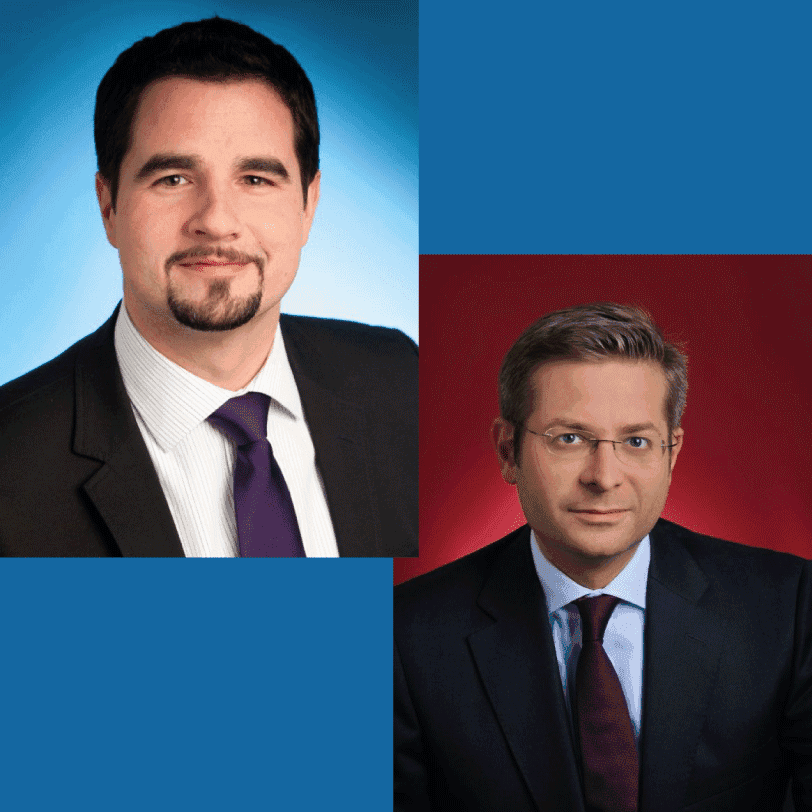

The Schoenherr team was led by Vienna-based Partner and Head of Banking & Finance Martin Ebner and Slovenian attorney Vid Kobe. The firm’s team also included Vienna-based Banking & Finance lawyers Stefan Paulmayer, Leopold Hoher, and Laurenz Schwitzer. Partners Christoph Lindinger and Wolfgang Holler were also involved, as were Slovenian Partner Ana Filipov and lawyers Bojan Brezan, Primoz Rojac, and Jurij Lampic; Croatian Partner Arijana Petres; and Belgrade-based lawyers Petar Kojdic and Dusan Obradovic (for Bosnia and Herzegovina), Milos Lakovic and Dejan Boric (for Montenegro), and Partner Matija Vojnovic and lawyers Petar Kojdic and Luka Lopicic (for Serbia).

Houlihan Lokey acted as financial advisor for the coordination committee. The Mercator Group was also advised by Lazard and PwC.

As recently reported by CEE Legal Matters (June 9, 2014), in 2013 Mercator was acquired by Agrokor. The aqcuisition was conditional upon competition commissions clearance, and the recent approval of the Serbia, Croatia, Slovenia, Kosovo, Macedonia, Bosnia and Herzegovina, Montenegro, and Albania authorities thus clears the path for the EUR 240 million deal to be finalized.