Wardynski & Partners announced it is launching a new interdisciplinary practice to provide regulatory, tax and transactional advice in the area of new technologies.

The “New Technologies” practice is meant to cater to the needs of companies operating in a number of fields: biomedical and modern foods, creative industries, crowdfunding, cybersecurity, e-commerce, financing of new technologies, gaming, information technology, new payment solutions, new technologies in searching for energy, public-private partnership projects (PPP), protection of privacy, research and development (R&D), and telecommunications.

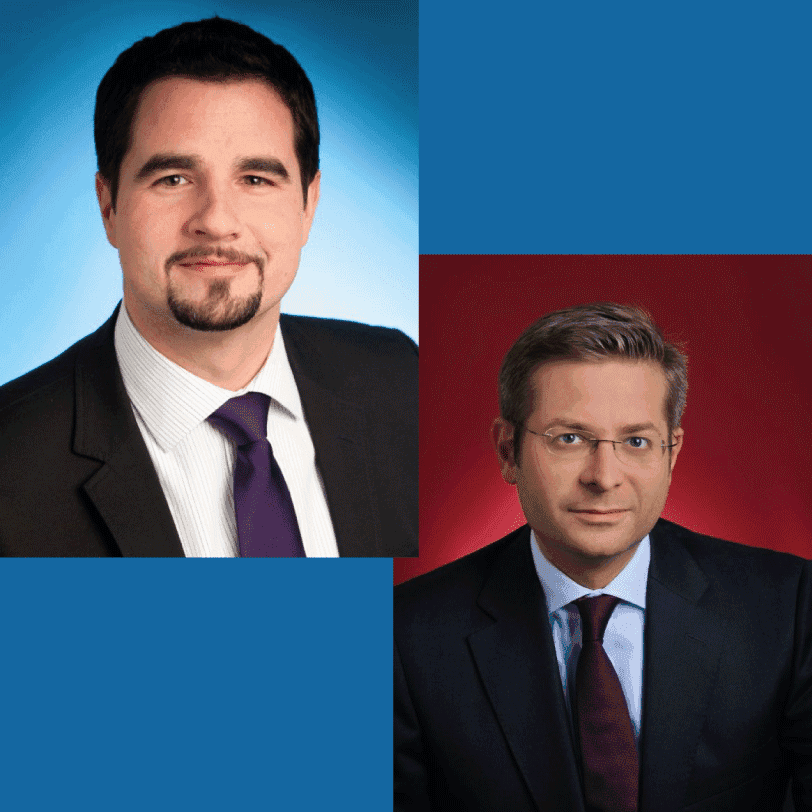

The team will be led by Partners Anna Pompe — the co-head of the Wardynski & Partners intellectual property practice — and Krzysztof Wojdylo, a member of the firm’s regulatory and payment services practices. Other members of the team include tax adviser Joanna Prokurat and technology adviser Krzysztof Rutkowski.

“For us, new technologies are all about new legal challenges,” said Wojdylo. He added that “businesses in this sector have issues with the legal classification of innovative goods and services, as innovations develop more quickly than the legal system can regulate them. This creates demand for highly specialized legal services targeted to specific segments of the new technologies market. Lawyers advising in these areas must have a firm understanding of the nature of innovation as well as the particular industry.”